Metasurface Technologies

Semicap subsystem provider exposed to the cyclical upturn

In this note, we briefly profile a company that is leveraged to the impending boom in the semicap cycle. This note is brief because the write-up done by Collyer Bridge and Iqbal Yusuf is solid. Their write-up on the company can be found here. Collyer Bridge’s write-ups and research, generally, are second-to-none. Below, we simply lay out the thesis in brief and then add in some extra points.

The thesis is straightforward, and not dissimilar to our Wasion thesis.

The rise of AI has caused a major increase in the demand for all types of chips: logic, memory and GPU. Demand has now increased to such a point where supply is drastically insufficient to meet it. We see this in various signals:

The price of DRAM and NAND memory has increased multifold.

Intel has pointed to shortages of logic chips. If logic chips are in shortage, being further along the chain of AI requirements, then think about what that means in terms of shortages in other parts of the ecosystem!

TSMC recently announced a significant uptick in capex plans after the CEO spoke with each of the American hyper-scalers. Memory manufacturers have similarly laid out significant capex expansion plans.

It’s clear to us that there aren’t enough machines churning out all kinds of chips. Fabs, seeing the expansion signals from their end customers being far in excess of what their own expansions can deliver, are beginning to buy a lot more chip-making equipment. A new upturn in the semicap cycle has begun.

The question becomes how to play this new theme. We believe Metasurface Technologies is a great way to play it. As a starting point, 90% of the company’s revenues comes from semicap producers. Secondly, the company is highly exposed to Applied Materials’ memory machines, providing them with precision parts.

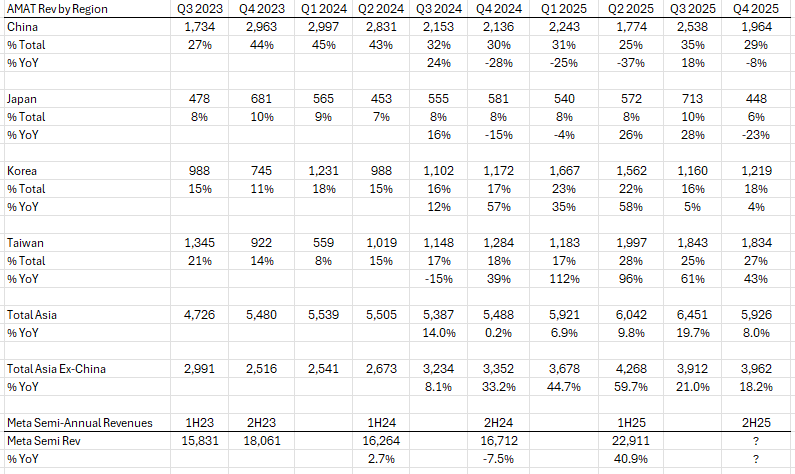

We’re fairly confident that Metasurface provides parts related to both memory and higher-end logic machines. When we look back through Metasurface’s historic revenue growth, it is much more closely tied to AMAT’s revenues in Taiwan, Japan and South Korea, rather than China:

The big jump in half-year revenues for Metasurface is more closely tied (both directionally and in quantum) to growth rates in Asia ex-China than solely to China. Taiwan is home to leading-edge chip manufacturing and Japan and Korea house the world’s major memory fabs. Therefore, it’s highly likely that Metasurface’s revenues are correlated to these particular semicap sectors. It’s these sectors that are growing the fastest. And even if their parts are tied to less advanced logic machines, AI re-prioritisation is beginning to cause a shortage in this segment as well.

The company currently trades at a market cap of around SGD 44 million. The company will probably earn around SGD 6-7 million annualised net income in the second half of 2025. Even when ignoring all the cash and investments on its balance sheet, the stock trades at around 6.5x historic earnings.

This looks cheap to us, considering that (i) most semicap stocks trade around 35x historic earnings or more (ii) smaller companies tend to (though not always) grow revenues and margins faster than bigger ones during a cyclical upturn, and (iii) a cyclical upturn in semicap is just beginning.

The thesis in short-form:

A significant ramp in demand for semicap equipment will start this year.

This ramp for memory, GPU and logic chip-making machines will require a lot more of Metasurface’s machined parts.

As investors come to recognise the company’s earnings potential and the inferential link between dot point 1 and 2, they will apply a much higher multiple on growing earnings for multi years ahead.

While we could be wrong on the inference, we believe Metasurface Technologies is a compelling risk-reward. We thank Collyer Bridge and Iqbal Yusuf for their research.

Really solid connection between TSMC's capex acceleration and the downstream implications for precision parts suppliers like Metasurface. The correlation analysis with AMAT's Asia ex-China revenues is particularly telling because it sidesteps the geopolitical noise and focuses on where actual leading-edge capacity expansion is happening. I've been trackng semicap equipment makers but hadn't considered the sub-tier suppliers trading at such massive valuation discounts. The 6.5x earnings for a company exposed to what's likely a multi-year upcycle seems way too cheap considering how supply-constrained the entire chain is right now.